This blog will break down why businesses are moving their manufacturing from China to Mexico. After reading it, business leaders will be able to evaluate if their business could benefit from moving its manufacturing.

China - The World’s Factory

For decades, companies have taken advantage of the low-cost labor in China to produce their products, but times are changing. With rising labor costs, tariffs, and delays, many companies are looking for alternatives to China for their manufacturing needs. In this article, we will examine why companies are shifting away from China and what that means for their supply chains.

For years, cost competitiveness was a major factor that drove companies to source their production from Chinese factories. But now, cost competitiveness has begun to erode due to increasing wages and other factors. The unit labor cost of manufacturing has increased by 285% in the past 20 years.

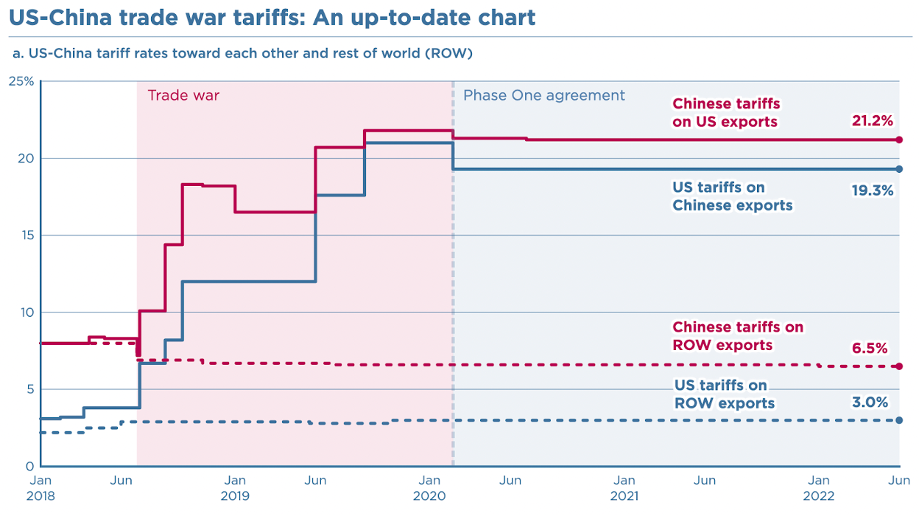

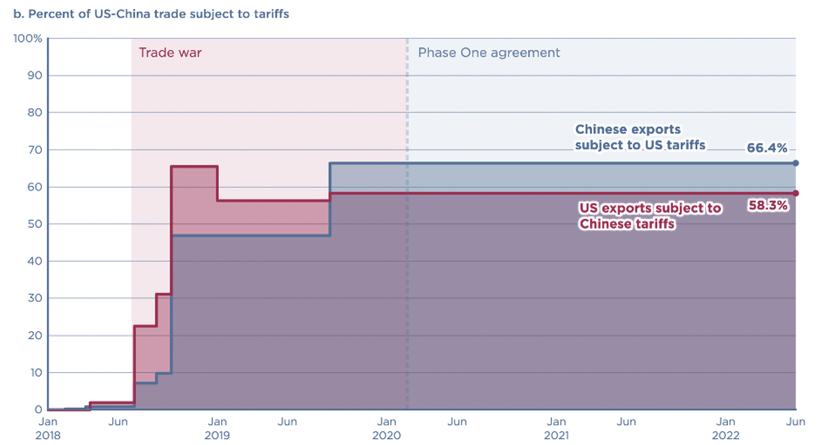

Along with rising costs in China, many companies have been affected by tariffs imposed on goods produced there. Some businesses have chosen to move production out of the country due to the increased costs that come with these tariffs.

Source: Peterson Institute for International Economics

Supply chain diversification is a critical consideration for businesses today, with concerns about intellectual property theft driving the exploration of alternative manufacturing sites. Many companies are looking beyond China to mitigate the risk of their products being copied and sold as knock-offs by competitors worldwide. Mexico, in particular, offers a compelling solution through nearshoring. By relocating manufacturing operations to Mexico, executives can benefit from a shorter travel distance, allowing for quick and efficient visits to manufacturers without extended periods away from their core business operations.

Alternatives to Manufacturing in China

Several alternative countries have the potential to compete with China in the manufacturing industry. Vietnam, India, Mexico, Thailand, Taiwan, Cambodia, and other emerging economies are among those that are well-positioned to take on manufacturing responsibilities previously dominated by China. These countries form highly interconnected markets, often relying on China for subcomponents used in finished goods. However, the ongoing trend of diversifying manufacturing sources is a positive move towards reducing dependence on a single country. This shift, though beneficial, does pose certain challenges that need to be addressed.

The countries below stand out as excellent alternatives to China in specific product categories. Here's a breakdown of these countries and the products they excel in:

1. India: For large corporate diversification, India is a go-to option. It benefits smaller customers and strengthens the manufacturing and supply chain ecosystem. While India currently has no additional tariffs, it may not be suitable for all products. However, its relatively low language barrier and availability of suppliers online make it an attractive option. India is particularly known for industries such as apparel and textiles, furniture, and kitchen and cooking products.

2. Thailand: In Thailand, small businesses can find a favorable environment. The absence of additional tariffs, lower minimum order requirements, and the inclusion of design services with manufacturing make it an attractive alternative. Thailand specializes in products such as auto parts, machinery and tools, jewelry, molded plastic products, and apparel and textiles.

3. Vietnam: Vietnam is a viable option for industries like PCBA (Printed Circuit Board Assembly), furniture, apparel, and agriculture products. With no additional tariffs, Vietnam offers some opportunities for diversification. However, it may not be the ideal choice for all products due to longer lead times and higher minimum order quantity requirements. Finding suppliers online can be challenging in Vietnam.

4. Mexico: Proximity to the U.S. makes Mexico a compelling alternative. It offers short lead times, low minimum order requirements, and language compatibility, with many factories having English speakers on staff. Mexico excels in industries such as automobiles, aviation and aerospace, medical devices, apparel and textiles, and consumer products. Moreover, it boasts a highly skilled workforce.

Each of these countries presents unique advantages and specializes in different product categories. Considering these alternatives can help businesses diversify their manufacturing and supply chain strategies while reducing reliance on China. However, one concern that we hear over and over is about geo-political risk impacting the flow of goods from Asia to the USA. This allows Mexico to shine as a sourcing alternative to China and other Asian countries.

Factors Leading to the Growth of Nearshoring in Mexico

To fully understand the factors behind the growth of nearshoring and manufacturing in Mexico, it is important to look at the historical context. Before China became the global manufacturing powerhouse that it is today, Mexico held that position. This was largely due to the 1994 North Atlantic Free Trade Agreement (NAFTA, now replaced with the USMCA), which played a pivotal role in the expansion of manufacturing in Mexico. The agreement, signed between Mexico, Canada, and the US, incentivized top OEMs like Motorola and Texas Instruments to establish their manufacturing operations in Mexico.

The presence of these OEMs in Mexico not only stimulated the growth of advanced manufacturing industries but also fostered the development of supporting parts, components, and materials makers within the country. Moreover, the establishment of manufacturing operations in Mexico attracted the requisite engineering and manufacturing talent, helping to build a skilled labor force in the country.

Mexico - The Nearshore Leader

Nearshoring is the process of bringing a company's production closer to its customer base. This simplifies logistics, transport, and managerial support while improving cash flow, simplifying the planning process, and reducing supply chain risks. There are many reasons why companies are beginning to look to nearshore production in Mexico for their manufacturing needs over China. Let's explore the benefits of nearshoring in Mexico more thoroughly.

Competitive Labor Costs

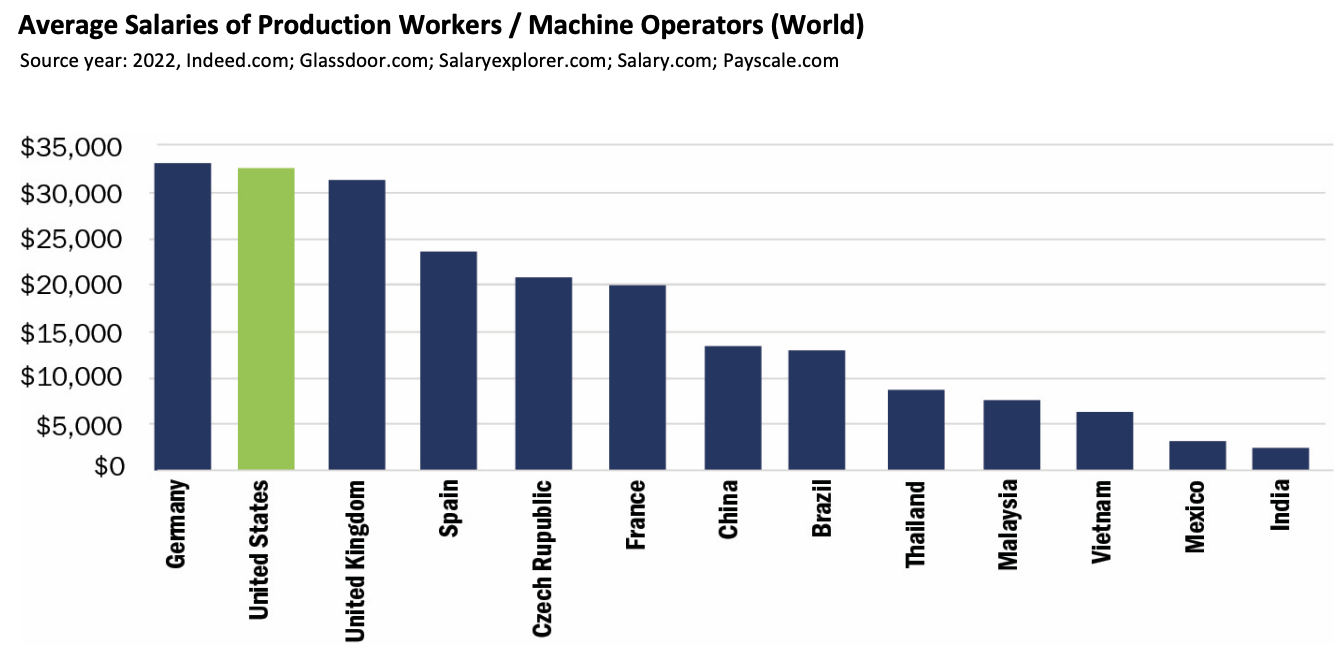

Before embarking on the strategic decision to shift operations to Mexico, companies must conduct a comprehensive financial evaluation to ensure a smooth and successful transition. Key aspects of this evaluation include analyzing competitive labor costs in Mexico compared to other manufacturing hubs. Over the past decade, the landscape of manufacturing wages has seen significant shifts. A decade ago, Mexican wages were notably 600% higher than those paid to manufacturing workers in China.

As of 2019, data reveals that Mexico boasts favorable labor costs, with an average wage of $3.95 per hour, significantly lower than the $4.50 per hour rate in China. Furthermore, Mexico's minimum wage stands at 257% below that of China, making it an appealing choice for cost reduction while upholding quality standards. In addition, it is crucial to consider the ramifications of low tariffs resulting from the US-Canada-Mexico Free Trade Agreements. These agreements have effectively minimized or eliminated tariffs on goods within the region, promoting enhanced trade, improved efficiency, and broader market access. By taking into account the advantages of labor costs and tariff reductions, companies can make well-informed financial decisions when contemplating the relocation of their operations to Mexico.

However, it is important to address concerns about labor protection laws in Mexico. Despite the lower labor costs, Mexico has a robust labor regulation system in place. Government auditors regularly visit factories to ensure compliance with labor and social protection measures, actively monitoring against child labor and slavery. Mexican workers also have the freedom to return to their own private homes, unlike in China where workers are often housed in controlled campuses or dormitories.

Additionally, the Mexican government has taken steps to strengthen labor rights. In 2021, new laws were introduced to safeguard the rights of temporary and casual workers, as well as subcontractors. These laws aim to provide social welfare contributions for these workers and ensure that they enjoy similar rights to full-time employees.

Therefore, nearshoring in Mexico not only offers competitive labor costs but also demonstrates a commitment to protecting workers' rights and ensuring ethical work practices. Companies can benefit from the cost advantage while operating within a strong regulatory framework that prioritizes labor protection and welfare.

Low Tariffs Because of US-Canada-Mexico Free Trade Agreements

The US-Canada-Mexico Free Trade Agreements, starting with the 1994 NAFTA agreement and later modified by the 2019 USMCA agreement, have had a significant impact on tariffs in the region. One of the main hallmarks of these agreements was the elimination or reduction of tariffs on goods being imported or exported within the region. This approach has fostered increased trade and economic integration among the three countries.

By abolishing or keeping tariffs at low rates, the free trade agreements have facilitated the flow of goods and services among the participating nations. This has led to increased trade volumes, efficiency gains, and expanded market access for businesses within the region. It has also provided consumers with access to a wider range of goods at competitive prices.

The low tariff rates have been especially beneficial for businesses engaged in cross-border trade. Companies in the United States, Canada, and Mexico have been able to export their products at lower costs, making them more competitive in international markets. This has resulted in job creation, increased investment, and enhanced economic growth. Particularly, the automotive, agricultural, and manufacturing sectors have experienced notable benefits from these agreements.

However, it is important to note that while the USMCA generally retains the low tariff rates established by NAFTA, there have been specific exceptions. For instance, tariffs on automotive products, aluminum, steel, and certain agricultural produce have been modified to protect domestic industries, particularly in the United States. These adjustments aim to balance the interests of all participating nations and ensure fair competition within the agreement.

Comparatively, the impact of low tariffs in the USMCA region differs significantly from the trade relationship between the United States and China. The US-China trade conflicts under the Trump administration resulted in the US imposing steep tariffs on a wide range of Chinese products, with many rates reaching 25% or even higher. In contrast, the tariff rates within the USMCA region remain considerably lower, facilitating a more harmonious and open trading environment.

Shorter Delivery Times & More Reliable Supply Chains

When exploring the advantages of nearshoring manufacturing operations to Mexico from China, it is essential to consider the broader strategic benefits beyond mere cost savings. Proximity plays a significant role in reducing delivery times and improving supply chain reliability when choosing to manufacture in Mexico. Transporting products from China typically takes four to six weeks, whereas transportation from Mexico to the US can be completed within two to six days, reducing delivery times by over 75% on average. This significant reduction allows companies to enhance planning and forecast accuracy, enabling adjustments to manufacturing plans within weeks in Mexico compared to months in China.

Cash Flow, Planning, and Risk

In addition to shorter delivery times, nearshoring in Mexico offers numerous advantages for cash flow, planning, and risk management. Financing inventory through payables is often limited when sourcing from China, tying up working capital and becoming costly as interest rates rise. Economic and geopolitical conditions, such as slower economies and supply chain risks, present planning challenges for businesses heavily reliant on sourcing from China. In contrast, nearshoring in Mexico provides more flexible financing options, shorter planning cycles, and reduced geopolitical risks.

Proximity and Time Zone Advantages

Executives also benefit from the convenience of visiting manufacturers in Mexico with just a simple one-to-two-day trip, promoting streamlined communication and efficient collaboration. Mexican factories have cultivated a culture of quality production with a zero-defect mindset, ensuring customer satisfaction by proactively addressing any substandard components detected during the production process. Additionally, Mexico offers readily available third-party certifications through independent laboratories, guaranteeing products meet stringent standards of excellence and safety. These advantageous features, along with the combination of skilled labor, cost-effectiveness, and commitment to quality, make Mexico an ideal manufacturing destination for companies looking to optimize their operations.

Highly Qualified Workforce

Mexico has made significant investments in the development of its manufacturing sector, yielding remarkable results. In fact, Mexico graduates more engineers per capita than many other countries, including the United States. This abundance of skilled labor, coupled with affordable costs, makes Mexico an attractive destination for companies seeking access to high-quality talent without compromising their operational budgets. By capitalizing on Mexico's manufacturing capabilities, businesses can enjoy long-term benefits while maintaining cost-effectiveness.

Product Quality

Mexican factories have fostered a culture of quality production with a zero-defect mindset, prioritizing customer satisfaction. In the event of any substandard components detected during the production process, Mexican factories proactively halt operations to consult with the customer, ensuring that only the highest-quality products are delivered.

Furthermore, Mexico offers readily available third-party certifications through independent laboratories, providing businesses with a reliable means to ensure their products meet stringent standards of excellence and safety. With these advantageous features and more, businesses are increasingly opting to relocate their operations from China to Mexico. The combination of favorable factors such as proximity, skilled labor, cost-effectiveness, commitment to quality, and streamlined communication channels make Mexico an ideal manufacturing destination for companies seeking to optimize their operations.

What businesses are a fit for manufacturing in Mexico?

As a business leader, you may be wondering if your company is a good fit for manufacturing in Mexico. Traditionally, the key industries that have been best suited to take advantage of Mexico's manufacturing capabilities were automotive, aerospace, appliances, consumer electronics, and medical devices. All of these industries typically require a high level of labor content with zero defects.

Mexico is continuing to expand its capabilities offering companies in a wide range of industries the opportunity to nearshore their manufacturing. Because of cost-competitive labor in Mexico and access to the same natural resources found in the USA, Mexico can support manufacturing many different types of products.

However, Steel and aluminum are highly subsidized materials in China. The only way to overcome these subsidies from a cost perspective in Mexico is with products that have 301 tariffs in place and/or have a high labor cost associated with the manufacturing process.

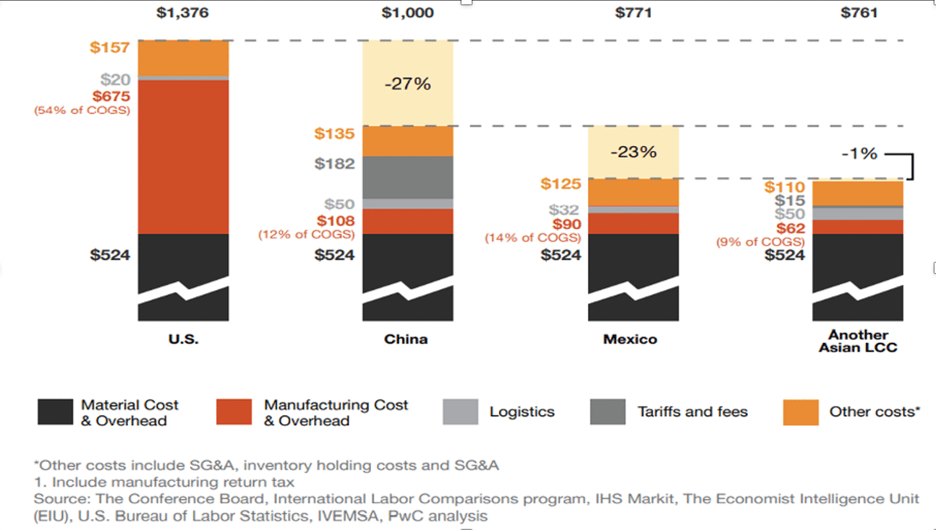

Evaluating Total Cost When Comparing China vs. Mexico vs. USA

Moving product manufacturing from China to the USA or Mexico is a complex decision. Traditionally, the key industries that have been best suited to take advantage of Mexico's manufacturing capabilities were automotive, aerospace, appliances, consumer electronics, and medical devices. All of these industries typically require a high level of labor content with zero defects.

However, it is essential to consider the role that total Supply Chain cost plays in determining where products are made. While Mexico offers cost-competitive labor and access to the same natural resources found in the USA, cost considerations are crucial for businesses when deciding on manufacturing locations. U.S. companies, despite appreciating the sentiment of "Made in the USA" and the potential benefits of bringing supply chains back within the country, must carefully evaluate the cost factor and whether their product differentiation can support being made in the USA if traditionally being sourced from China.

It is worth noting that the U.S. still has a way to go before it can compete with China, other overseas manufacturers, and even countries closer to home in terms of labor costs, specialized labor, and parts supply. While Mexico presents an attractive option due to its competitive labor costs, businesses must thoroughly assess the overall cost-effectiveness of manufacturing in different locations. Additionally, total landed costs, supply chain management costs, and potential risk tradeoffs should be evaluated to determine the ideal location for the manufacturing of goods.

By considering the advantages of manufacturing in Mexico, such as cost-competitive labor, access to resources, and the challenges facing the U.S. in terms of cost competitiveness, businesses can make informed decisions about where to manufacture their products. A thorough evaluation of costs, along with other factors, will ensure companies can optimize their productivity, innovation, and overall competitiveness in the global market. Moreover, nearshoring to Mexico offers distinct logistical benefits, notably the reduction in travel expenses and time for executives. This proximity facilitates better managerial oversight, enhances the quality of operations, and boosts productivity.

Additionally, moving manufacturing from China to Mexico decreases the need for executives to manage operations across vastly different time zones, reducing burnout and stabilizing management. Mexico’s strategic geographical location and participation in NAFTA (now USMCA) provide significant trade incentives, including the absence of heavy duty fees or protective tariffs, making it an ideal launchpad for the U.S. and other international markets. Furthermore, Mexico’s established maquila manufacturing system, with nearly five decades of operational history, ensures a smooth transition for businesses due to the familiarity of regulatory and cultural practices, mitigating potential bureaucratic surprises that might arise when relocating operations from countries like China.

Ready to learn more?

At Visigistics, our goal is to help you establish clear paths to reliable logistics.

To do this, we focus on understanding your business and current challenges, the current market, and what solutions are working in it. We utilize our team of experts in Supply Chain, US-Mexico Cross-Border logistics, International freight forwarding, and Domestic logistics to co-create solutions with you to improve your supply chains. Additionally, we actively research Supply Chain Strategies, Best Practices, and Market Trends and share our findings through Operational Excellence Roundtables. Our mission is to provide you with efficient and viable solutions that will make your logistics processes more streamlined and effective so you can be successful in today’s challenging market.

Book a discovery call to get started today!

At Visigistics, we understand that developing a successful strategy requires clear goals and implementation services to make it happen. We start with a detailed assessment of your business operations to identify potential areas for improvement and optimization. By taking into account current market conditions, customer requirements, supply chain dynamics, and more, we create a customized logistics plan designed to meet your specific needs.

We also offer services to give you the options that are essential in today’s fast-paced business environment. Our team of experts will work with you to develop and implement a strategy that can expand, grow, and adjust as needed so you can stay ahead of the competition. From transport management and storage solutions to the integration of digital systems, we have the resources to help you successfully manage the ever-changing business landscape.

At Visigistics, our mission is to provide you with reliable and cost-effective supply chain solutions that will take your business to the next level. With our customized strategies and optional services, you can rest assured knowing that we develop a strategy with clear goals for optimal logistic performance AND we implement services to make it happen.

Frequently Asked Questions:

How can leveraging Shelter Programs simplify the transition process for companies expanding their manufacturing operations into Mexico?

By leveraging Shelter Programs such as those provided by Co-Production International, companies expanding their manufacturing operations into Mexico can significantly simplify the transition process. These programs offer expert guidance to navigate the complexities of Mexican regulations, which can be challenging for companies unfamiliar with the local business environment. Through Shelter Programs, companies can benefit from the experience and knowledge of professionals who understand the intricacies of operating in Mexico, including compliance requirements, labor laws, and customs procedures. By utilizing these services, companies can streamline their expansion efforts, minimize risks, and establish a successful presence in the Mexican market more efficiently and effectively.

Why is it important for companies to leverage expert guidance when navigating Mexican regulations during a manufacturing transition?

It is crucial for companies to seek expert guidance when navigating Mexican regulations during a manufacturing transition for several reasons. Firstly, understanding and complying with Mexican regulations is essential to ensure a smooth and successful transition. These regulations can be complex and may vary significantly from those in other countries, so having expert guidance can help companies navigate this landscape effectively.

Additionally, by leveraging expert guidance, companies can benefit from the knowledge and experience of professionals who are familiar with the intricacies of Mexican regulations. This expertise can help companies avoid costly mistakes, delays, and potential legal issues that may arise from non-compliance or misunderstandings of the regulations.

Moreover, expert guidance can provide companies with insights into best practices, strategies, and solutions tailored to their specific needs when operating in Mexico. This can enhance overall efficiency, productivity, and profitability during the manufacturing transition process.

Ultimately, by partnering with experts who specialize in navigating Mexican regulations, companies can position themselves for success in the Mexican market, capitalize on opportunities, and achieve sustainable growth in a new business environment.

How does transportation and supply chain costs influence the decision to move manufacturing from China to Mexico?

Rising fuel prices are significantly impacting transportation and supply chain costs, prompting many manufacturers to consider relocating their production bases from China to Mexico. The key factor influencing this decision is the cost-efficiency gained in logistics. Transporting goods across the vast expanse of the Pacific Ocean demands considerable financial resources due to the long transit times and extended periods of inventory holding that are required. In contrast, Mexico, being geographically closer to the United States—the largest consumer market—allows for quicker and more cost-effective transportation of goods across the border. This logistical advantage is a powerful incentive for companies looking to reduce operational costs and enhance their supply chain efficiency by moving their manufacturing from China to Mexico. To learn more, read our article, "Mexico vs China: A Logistics Comparison".

What are some factors contributing to the shift in manufacturing from China to Mexico?

Several factors contribute to the shift in manufacturing from China to Mexico. Rising labor costs, tariffs, and supply chain diversification are key drivers behind this transition. Companies are looking for alternatives to China due to increasing wages and the impact of tariffs on goods produced there. Concerns about intellectual property theft are also prompting businesses to explore alternative manufacturing sites.

Mexico, in particular, offers a compelling solution through nearshoring, providing benefits such as shorter travel distances, efficient visits to manufacturers, and a skilled workforce. Historically, the growth of Mexico's manufacturing sector has been significantly incentivized by agreements like NAFTA, which not only eliminates duty fees and high protective tariffs but also positions Mexico as a strategic export hub due to its extensive network of free trade agreements with more countries than nearly any other nation in the world.

Moreover, the economic dynamics between Mexico and China have shifted dramatically. A decade ago, Mexican wages were 600% higher than those of manufacturing workers in China, but today they are only about 30% higher. Projections suggest that in just two years, Mexican wages could be 30% lower than those in China. This narrowing wage gap, coupled with the higher productivity levels of Mexican labor compared to Chinese workers, significantly enhances the return on investment for companies operating there.

Additionally, the financial strategies around currency values play a role. While China has been known to suppress the value of the yuan to boost exports, Mexico's peso remains more stable, making financial planning more predictable for businesses. The established maquila manufacturing system in Mexico, with its near 50-year history, further provides a stable and reliable manufacturing environment, eliminating many of the bureaucratic, cultural, or regulatory surprises that can be encountered when outsourcing across the Pacific.

With fuel prices continuing to rise, the geographical proximity of Mexico significantly reduces transportation and supply chain costs. It also allows for less travel expense for executives, which leads to more effective oversight, higher quality production, and increased productivity. These logistical advantages, combined with the strategic and economic benefits, make Mexico an increasingly attractive location for manufacturers seeking to relocate their operations from China.